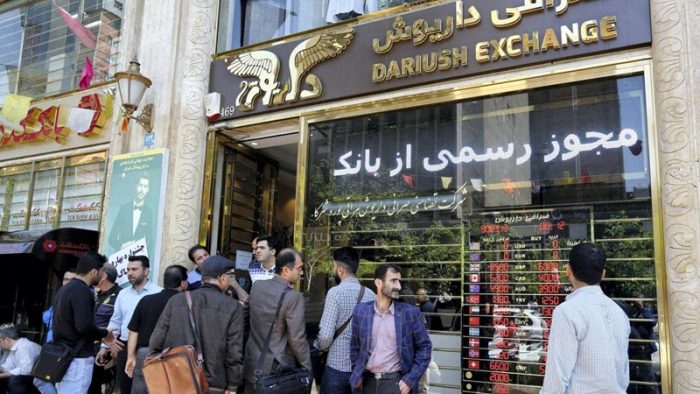

Rial continues to plunge in the exchange market, an indication of the surging economic crisis in Iran

Iran’s economy is starting to see the effects of U.S. sanctions, which began their first phase in August and are due to be fully reimposed next Monday, November 5th. An article published on ncr-iran.org on Thursday explains how the Iranian economy has been weakened by decades of corruption and mismanagement by the mullahs and why the regime is ill-equipped to address the snowballing economic crises now facing the country.

The mullahs' in #Iran have ruined the country's economy and the people are suffering as a result.https://t.co/XtOZ32HLkx

— People's Mojahedin Organization of Iran (PMOI/MEK) (@Mojahedineng) November 2, 2018

The economic climate in Iran was already unstable when the nationwide uprising, led by the MEK, began last December. The widespread protests and strikes, which continue today on a daily basis in cities across the country, have further weakened the economy. The addition of the United States’ withdrawal from the Iran nuclear deal in May was catastrophic. By every metric, the Iranian economy is failing. The NCRI article broke down Iran’s financial crisis in terms of numbers. Below is a summary of the data.

Gross Domestic Product (GDP)

The regime’s Parliament’s Research Center predicts a 0.8% drop in Iran’s GDP this fiscal year and a 2.5% drop next year. The International Monetary Fund (IMF) predicts a steeper decline, estimating a drop of 1.5% this year and 3.6% next.

Inflation

According to the Statistical Center of Iran, the inflation rate for the month of September alone was 5.4%. According to the Central Bank, the rate was 6.1%.

Exchange Rate

The regime artificially set the exchange rate at 42,000 rials per U.S. dollar in April, but the global exchange rate reached 200,000 rials per U.S. dollar in October. It is widely speculated that the volatile risk will plunge again, driving up prices for the already struggling Iranian people.

Unemployment

Iran has a double-digit unemployment rate, which is troubling, but the employment situation is much worse for those with college degrees, particularly young people. According to estimates, one-third of Iranian men and one-half of Iranian women under 30 with college degrees are jobless.

Housing Market

People are hesitant to buy property in an unstable economy. Prices are high, and home values could plummet at any time.

Exports

Exports are up immediately preceding the U.S. deadline for the reimposition of oil sanctions, but these are expected to fall dramatically next week.

The Iranian regime has not proposed a plan to address the economic cataclysm facing the nation. Its solutions are either patently ridiculous (banning the export of tomatoes) or actively harmful. Artificially setting the exchange rate did nothing to help the economy, but it did allow the IRGC to exploit the difference in the artificial rate and the global rate to profit off imports and exports.

The clerical regime has ravaged #Iran's economy by its missile and nuclear projects, warmongering and terrorism.#IranRegimeChange

— Maryam Rajavi (@Maryam_Rajavi) July 30, 2018

While the people of Iran suffer from the consequences of the mullahs’ corruption and mismanagement, the regime continues to bungle every attempt at handling their self-made crisis and profits from their own incompetence.

The economy will not recover as long as the mullahs are in charge.

Staff Writer